In the fast-evolving world of blockchain technology, Decentralized Exchanges (DEXs) have emerged as a groundbreaking innovation, challenging traditional financial systems by enabling peer-to-peer trading with enhanced security and privacy. However, like any trading platform, DEXs face the quintessential challenges of liquidity and price efficiency. This article aims to dissect the intricate mechanisms of liquidity pools and arbitrage strategies in DEXs, offering a detailed, data-driven analysis of how these elements interact to shape market dynamics. From the fundamentals of decentralized exchanges to the economic implications of liquidity and arbitrage, we delve into an exhaustive exploration of these key components. Whether you’re a trader looking to optimize your strategies, an investor seeking long-term gains, or a policy-maker aiming to understand this burgeoning financial landscape, this piece offers valuable insights for all.

Overview of Decentralized Exchanges (DEXs)

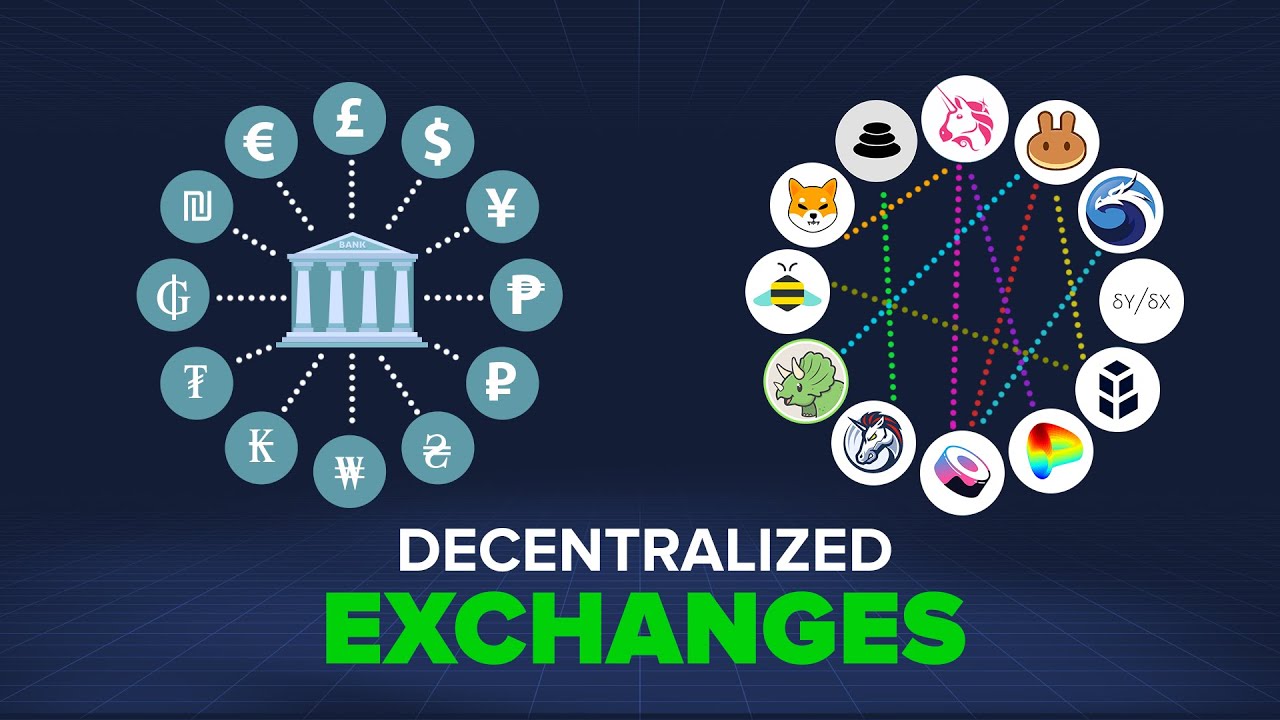

Decentralized Exchanges (DEXs) are trading platforms that operate without a centralized governing body. Unlike their centralized counterparts, which act as middlemen between traders, DEXs facilitate peer-to-peer trading directly between users. Key features of DEXs include enhanced security due to distributed ledgers, greater privacy because of fewer identity checks, and potentially lower fees. The evolution of DEXs has been rapid, spurred by advancements in blockchain technology and smart contracts, challenging the traditional financial exchange landscape.

Importance of Liquidity and Arbitrage in DEXs

Liquidity: In any trading environment, liquidity is crucial, but its importance is heightened in DEXs. Liquidity refers to the ease with which assets can be bought or sold without affecting the asset’s price. High liquidity ensures faster transaction times and lower slippage, enhancing the overall user experience.

- Role in Price Stability: High liquidity levels help in maintaining price stability by mitigating drastic price fluctuations. This makes the trading environment more predictable and safer for traders.

- Impact on User Experience: High liquidity generally translates into better trading conditions, including lower fees and faster trade execution, ultimately enriching the user experience.

Arbitrage: Arbitrage plays a critical role in DEXs, contributing to both liquidity and price efficiency. In essence, arbitrage involves buying an asset in one market and simultaneously selling it in another at a higher price.

- Price Efficiency: Arbitrage helps in maintaining price parity across various exchanges, decentralized or otherwise. This is particularly essential for DEXs, which might otherwise suffer from price inconsistencies due to lower trading volumes.

- Volume: By taking advantage of price differentials, arbitrageurs bring in additional trading volume. This activity not only makes the market more dynamic but also indirectly contributes to improving liquidity.

Objective and Scope of the Article

Objective: The primary goal of this article is to delve into the complexities and nuances of liquidity pools and arbitrage within decentralized exchanges. We aim to provide a comprehensive, data-driven analysis to inform traders, investors, and even policymakers about these critical market mechanisms.

Scope: This article will focus on explaining liquidity pools and arbitrage through real-world examples, primarily drawing from popular DEXs like Uniswap and Sushiswap. We will be using empirical data, case studies, and expert opinions for a balanced view. However, the article will not explore the regulatory landscape surrounding DEXs or liquidity pools, as that is a separate and expansive topic in itself.

Background

Now that we have laid the groundwork, let’s delve into the heart of the matter by exploring what Decentralized Exchanges (DEXs) are and what sets them apart from traditional trading platforms.

What Are Decentralized Exchanges?

Now that we’ve introduced the concept of Decentralized Exchanges, let’s delve deeper into their definition and the key characteristics that distinguish them from centralized platforms.

Definition and Key Characteristics

Decentralized Exchanges (DEXs) are trading platforms that operate without the involvement of a central authority or intermediary. Built on blockchain technology, DEXs facilitate direct peer-to-peer transactions between users. Key characteristics include:

- Anonymity: User identities are often shielded, offering a higher degree of privacy.

- Censorship Resistance: Being decentralized, these platforms are less susceptible to localized regulation or control.

- Ownership of Funds: Users have full control over their funds, as they are stored in personal wallets rather than in a centralized depository.

- Transparency: All transactions are recorded on a public ledger, making the exchange operations transparent.

Benefits and Limitations

While the decentralized architecture and key features of DEXs offer a unique set of advantages, it’s crucial to also consider the challenges and limitations inherent to these platforms.

Benefits:

- Lower Fees: Most DEXs have lower fees compared to centralized exchanges.

- Enhanced Security: The decentralized nature significantly minimizes the risk of hacks.

- User Control: Full control over one’s assets and data.

Limitations:

- Lack of Liquidity: Typically, DEXs suffer from lower liquidity when compared to centralized exchanges.

- Technical Complexity: The platforms are often not as user-friendly and require some degree of technical knowledge.

- Limited Trading Pairs: Often, DEXs offer fewer trading pairs compared to their centralized counterparts.

Centralized vs Decentralized Exchanges

With a foundational understanding of what Decentralized Exchanges (DEXs) are and their key characteristics, it’s important to contrast them with their more traditional counterparts: Centralized Exchanges (CEXs). Although both types of exchanges serve as platforms for trading digital assets, the principles guiding their operations are fundamentally different. In the following section, we’ll delve into a side-by-side comparison to better appreciate the advantages and limitations of each.

Liquidity

Centralized Exchanges: Often have higher liquidity due to a larger user base, professional market makers, and higher trading volumes.

Decentralized Exchanges: Generally suffer from lower liquidity, although liquidity pools and protocols are being developed to address this issue.

Security

Centralized Exchanges: More susceptible to hacking and fraud due to the central point of failure.

Decentralized Exchanges: More secure as they are based on blockchain technology, reducing the risk of hacking. However, they are not entirely immune to risks like smart contract vulnerabilities.

User Experience

Centralized Exchanges: Typically offer a more user-friendly experience with better interfaces, customer support, and additional services like fiat on-ramps.

Decentralized Exchanges: Often more complex to use and lack customer support, making them less suitable for beginners.

Governance

Centralized Exchanges: Governed by a single entity, which makes decisions on listing fees, trading pairs, and other operational aspects.

Decentralized Exchanges: Usually governed by community voting, offering a more democratic approach but can be slower to adapt to market needs.

Understanding Liquidity Pools

After understanding the fundamental aspects of Decentralized Exchanges, it’s important to delve into one of their core mechanisms: liquidity pools. These pools serve as the backbone of many DEXs, enabling fluid trading and contributing to market efficiency.

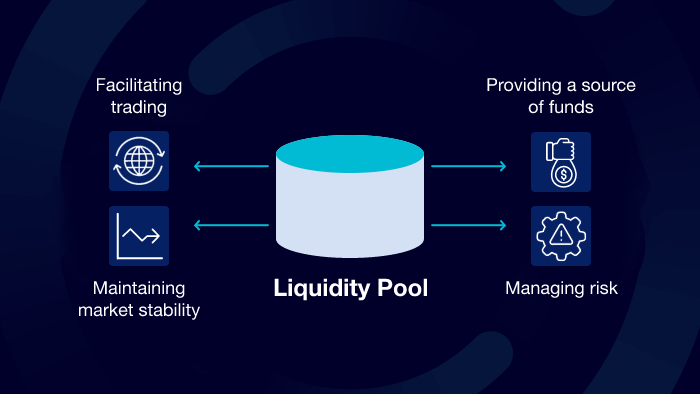

Concept of Liquidity Pools

Liquidity pools are smart contract-based reservoirs that contain funds for facilitating trading on Decentralized Exchanges. These pools hold assets that users can trade against and serve as a counterpart for traders when there’s no immediate buyer or seller. They enable DEXs to offer better rates and more trading pairs than would be possible if they relied solely on peer-to-peer transactions.

How They Work

Transitioning from the theoretical concept to the practical application, let’s explore how liquidity pools actually function. At a high level, liquidity providers deposit equal amounts of two tokens into a pool. These pools are then utilized for trading, earning fees for the liquidity providers based on the trading volume. Algorithms like the Constant Product Market Maker Model (used in Uniswap) determine the price of tokens in the pool, ensuring that prices are adjusted in real-time based on supply and demand.

Examples of Popular Liquidity Pools

Having grasped how liquidity pools operate, it’s worthwhile to look at some real-world implementations to get a holistic understanding.

- Uniswap: One of the earliest and most popular DEXs, Uniswap leverages an automated market maker model. It has a wide range of liquidity pools across various Ethereum-based tokens.

- Sushiswap: Originally a fork of Uniswap, Sushiswap has expanded its offerings with additional features and community governance, making it a strong player in the liquidity pool arena.

- PancakeSwap: Operates on the Binance Smart Chain and is known for its low transaction fees compared to Ethereum-based platforms. It has quickly gained popularity, offering a variety of pools and yield farming options.

Pros and Cons of Liquidity Pools

Before delving deeper into the symbiosis between liquidity pools and arbitrage, it’s crucial to understand the advantages and drawbacks associated with liquidity pools.

Pros:

- Steady Earnings: Liquidity providers often earn fees from the trading volume, offering a more predictable income stream compared to pure trading.

- Price Stability: A well-funded liquidity pool can buffer against significant price swings, contributing to market stability.

- Accessibility: Even those with smaller capital can contribute to liquidity pools, democratizing the earning potential in DEXs.

Cons:

- Impermanent Loss: The downside of earning through liquidity pools, where asset values can diverge and lead to potential losses compared to simply holding the tokens.

- Smart Contract Risk: Pools rely on smart contracts, which, if flawed, could pose security risks.

- Gas Fees: For pools on networks like Ethereum, high gas fees can erode profits for liquidity providers, especially those with smaller contributions.

Role of Arbitrage in DEXs

Having delved into the intricacies of liquidity pools, it’s important to explore another vital mechanism that keeps decentralized exchanges functioning optimally: Arbitrage. Arbitrage opportunities not only keep assets priced correctly across different trading venues but also contribute significantly to liquidity.

What Is Arbitrage?

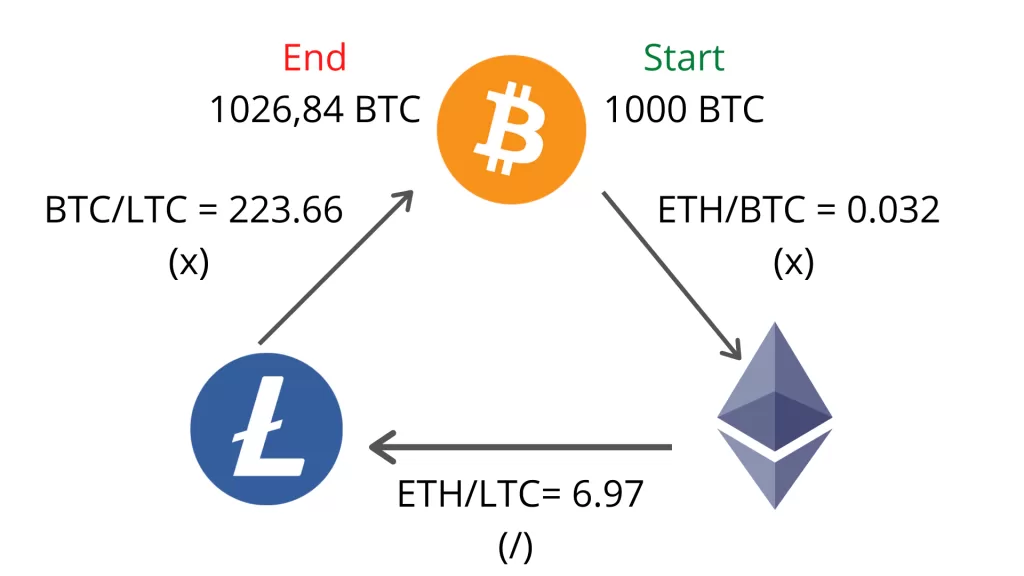

After setting the stage with liquidity pools, let’s transition into the concept of arbitrage, which often complements and enhances the utility of liquidity pools in DEXs. Arbitrage is the practice of buying an asset in one market and selling it in another to profit from a difference in price. Arbitrageurs essentially keep the market efficient by taking advantage of price differences between different trading platforms, thereby providing liquidity and aligning prices across markets.

Types of Arbitrage Strategies

Now that we understand what arbitrage is, let’s delve into the types of strategies that arbitrageurs commonly employ in decentralized exchanges.

- Spatial Arbitrage: This involves exploiting price differences between different markets or exchanges. For example, buying a token on Uniswap and selling it at a higher price on Sushiswap.

- Temporal Arbitrage: This strategy is based on time-sensitive price differences within the same exchange or market. Arbitrageurs might buy an asset expecting a short-term price change and sell it once the anticipated price change has occurred.

- Statistical Arbitrage: This is a more complex form that involves mathematical models and algorithms to identify arbitrage opportunities. It often uses historical data to predict future price discrepancies.

Benefits and Risks

Before wrapping up our discussion on arbitrage, it’s crucial to weigh its benefits and potential downsides as they pertain to decentralized exchanges.

Benefits:

- Market Efficiency: Arbitrage helps in correcting price discrepancies, making markets more efficient.

- Liquidity: By exploiting price differences, arbitrageurs contribute to market liquidity, indirectly benefiting both traders and liquidity providers.

- Risk Mitigation: Generally considered a low-risk strategy, as arbitrage profits are almost assured as long as the price difference exists.

Risks:

- Execution Risk: Timely execution is crucial for arbitrage, and delays can turn profits into losses.

- Costs: Transaction fees, especially in congested networks, can eat into arbitrage profits.

- Regulatory Risks: The lack of clear regulation around decentralized finance (DeFi) activities, including arbitrage, poses a potential legal risk.

By comprehensively understanding both liquidity pools and arbitrage, one gains a well-rounded view of the mechanisms that fuel decentralized exchanges. These elements often interact in complex ways, shaping the dynamics of decentralized financial markets in the process. Up next, we’ll explore how these two mechanisms coexist and contribute to a healthier, more robust DEX ecosystem.

Interaction Between Liquidity Pools and Arbitrage

After gaining insights into the roles of liquidity pools and arbitrage in decentralized exchanges (DEXs), it’s crucial to understand how these two mechanisms are interconnected. In many ways, they form a symbiotic relationship that is essential for the efficient functioning of DEXs.

How Arbitrageurs Benefit from Liquidity Pools

Transitioning from the broader view, let’s first explore how arbitrageurs can benefit from liquidity pools. Liquidity pools offer a fertile ground for arbitrage opportunities. Given that prices within a pool are determined algorithmically, they may not always instantly reflect market prices. Arbitrageurs can capitalize on this by buying low in one exchange and selling high in another, thus pocketing the difference. Essentially, liquidity pools can act as either the source or the destination for arbitrage transactions, offering multiple avenues for profit.

How Liquidity Pools Benefit from Arbitrage

Next, let’s flip the coin and consider how liquidity pools benefit from the actions of arbitrageurs. The very activities of arbitrageurs bring an essential service to liquidity pools: they correct price discrepancies. When an arbitrageur buys from a pool where the asset is cheaper and sells where it is more expensive, they are effectively balancing out the prices, bringing them in line with broader market rates. This process enhances the pool’s integrity, attracts more liquidity providers, and ultimately makes the DEX more competitive.

Symbiotic Relationship

Finally, to tie everything together, let’s discuss the symbiotic relationship between liquidity pools and arbitrageurs. In a nutshell, liquidity pools provide the landscape for arbitrageurs to spot discrepancies and profit, while arbitrageurs help the pools by equalizing prices and contributing to market liquidity. This mutual benefit creates a dynamic and efficient ecosystem in decentralized exchanges, one where each mechanism reinforces the other.

Case Studies

While the theoretical underpinnings of liquidity pools and arbitrage offer critical insights, real-world examples can significantly enrich our understanding. In this section, we’ll delve into some case studies that illustrate how arbitrage has been successfully executed in decentralized exchanges (DEXs), and also explore the challenges and lessons learned from these experiences.

Real-world Examples of Successful Arbitrage in DEXs

To fully appreciate the role of arbitrage in DEXs, let’s look at some concrete examples where arbitrageurs have successfully capitalized on price discrepancies:

- Arbitrage Between Uniswap and Sushiswap: During the launch phase of Sushiswap, the platform offered exceptionally high rewards to attract liquidity providers. As a result, significant price discrepancies arose between Uniswap and Sushiswap. Arbitrageurs took advantage by swapping tokens on Uniswap and immediately selling them on Sushiswap, capitalizing on the price difference.

- Flash Loans and Arbitrage: Advanced users have employed flash loans—unsecured, instant loans—to engage in risk-free arbitrage. In one instance, an arbitrageur used a flash loan to borrow assets, swap them on one DEX for a better rate, and then repay the loan, all in a single transaction, netting a tidy profit.

- Stablecoin Arbitrage: Arbitrage opportunities often arise with stablecoins, such as USDC, DAI, and Tether, which are supposed to maintain a 1:1 peg with the U.S. dollar. Due to supply and demand dynamics, these stablecoins sometimes deviate from the peg, offering arbitrage opportunities between different DEXs.

Challenges and Lessons Learned

Transitioning from successes to pitfalls, let’s consider some of the challenges and lessons learned from these real-world examples.

- High Gas Fees: One of the significant drawbacks for arbitrageurs, especially in the Ethereum network, are the high gas fees which can eat into profits. The Uniswap-Sushiswap arbitrage was highly lucrative only until gas fees started to offset gains.

- Slippage: Especially in pools with low liquidity, large trades can cause considerable slippage, diminishing the profitability of an arbitrage opportunity.

- Timing: In decentralized exchanges, transaction times are not guaranteed, as they depend on network congestion and gas fees. Delays can make an otherwise profitable arbitrage opportunity result in a loss.

- Smart Contract Risks: As demonstrated by some infamous DeFi hacks, smart contracts are not always foolproof. Ensure the platforms you interact with have been audited and are considered secure.

Through these case studies, we can see the practical applications and limitations of arbitrage in DEXs. These real-world examples not only validate the theories but also highlight the complexity and the need for strategic thinking when participating in decentralized finance activities.

Economic Implications

While we’ve looked at the technical aspects and real-world applications of liquidity pools and arbitrage in DEXs, understanding their economic implications can provide a holistic view. This section aims to explore how these elements impact liquidity providers, end-users, and the overall DEX ecosystem.

Impact on Liquidity Providers

Starting with the first stakeholder group, liquidity providers stand to benefit considerably from the arbitrage activities in several ways. Firstly, arbitrage brings volume to the exchange, which translates into trading fees for liquidity providers. Secondly, arbitrageurs help in maintaining the asset prices close to market rates, making the pool more attractive for potential liquidity providers. However, it’s important to note that arbitrage activities can also introduce impermanent loss, a scenario where providing liquidity becomes less profitable due to price volatility.

Impact on End Users

Moving on to the next group significantly impacted by these activities: the end-users or traders. Arbitrage indirectly benefits traders by maintaining price stability within the DEX, thereby creating a more predictable and reliable trading environment. The work of arbitrageurs in aligning prices across different platforms ensures that traders get a fair deal, irrespective of the platform they use, which can encourage more participation in DEXs as compared to centralized exchanges.

Effect on Overall DEX Ecosystem

Lastly, let’s zoom out and look at the macro implications for the decentralized exchange ecosystem as a whole. The combined actions of liquidity providers and arbitrageurs contribute to a more efficient, liquid, and robust market. This increased market efficiency makes DEXs more competitive, potentially attracting more users and liquidity to decentralized platforms. Over time, as DEXs continue to mature and incorporate additional features like Layer 2 scaling solutions, the economic benefits can be more widely distributed, further solidifying the value proposition of decentralized trading platforms.

By examining these economic implications, we gain a comprehensive understanding of the far-reaching impact of liquidity pools and arbitrage in decentralized exchanges. Their interaction is not merely a technical convenience but a critical economic mechanism that can influence everything from individual profits to the broader market landscape.

Advanced Considerations

While we have covered the foundational elements and their broad economic implications, there are also advanced considerations that can influence the profitability and risks associated with liquidity pools and arbitrage in decentralized exchanges (DEXs). In this section, we will delve into some of these complexities, including Front Running and Miner Extractable Value (MEV), Impermanent Loss, and the impact of Gas Fees on arbitrage.

Front Running and Miner Extractable Value (MEV)

First on our list of advanced considerations is the issue of front-running, a practice where transactions are prioritized to take advantage of known future trades. In the context of blockchain, miners can reorder transactions within a block to their advantage, a concept known as Miner Extractable Value (MEV). This is particularly relevant for arbitrageurs as their profitable trades can be front-run by miners or other arbitrage bots, affecting the profitability and fairness of arbitrage opportunities.

Impermanent Loss in Liquidity Pools

Next, let’s delve deeper into a phenomenon often glanced over but crucial for liquidity providers: impermanent loss. This occurs when the price ratio of tokens in a liquidity pool changes, and the automated market maker (AMM) model used by DEXs reallocates assets within the pool. As a result, liquidity providers might end up with a less favorable composition of assets compared to simply holding them. While arbitrage activities help in reducing price discrepancies, they can also exacerbate impermanent loss for liquidity providers, which can sometimes outweigh the trading fees earned.

Gas Fees and Their Impact on Arbitrage Profitability

Lastly, let’s focus on a more tangible issue affecting both liquidity providers and arbitrageurs: gas fees. Gas fees, the transaction costs on blockchain networks like Ethereum, can heavily influence the profitability of arbitrage. High gas fees can eat into profits or even render an arbitrage opportunity unprofitable. For liquidity providers, high gas fees can act as a barrier to adjust or withdraw their provided liquidity, thus making the pool less dynamic and adaptable to market conditions.

Understanding these advanced considerations adds layers of complexity to our knowledge of decentralized exchanges, liquidity pools, and arbitrage. These complexities serve as both opportunities and pitfalls for market participants, underscoring the need for informed decision-making and ongoing education in the rapidly evolving DeFi landscape.

Conclusion

As we reach the end of our in-depth exploration, it’s essential to revisit the key findings and insights garnered about liquidity pools and arbitrage in decentralized exchanges (DEXs). From the basic concepts to real-world applications and advanced considerations, we’ve traversed a comprehensive landscape that sheds light on the complex but rewarding world of DEXs.

Summary of Key Findings

Our exploration began with an understanding of decentralized exchanges, elucidating their advantages and limitations, especially in terms of liquidity and security. We then dissected the roles of liquidity pools and arbitrage, revealing their symbiotic relationship essential for the efficient functioning of DEXs. Real-world case studies provided practical applications and lessons, while the economic implications and advanced considerations added layers of complexity and nuance to our understanding.

Strategies for Effective Utilization of Liquidity Pools and Arbitrage

For those looking to actively participate, a few strategies stand out:

- For Liquidity Providers: Be cautious about the pools you join, paying attention to trading volumes, pool ratios, and potential impermanent loss. Choose pools that align with your risk tolerance and investment strategy.

- For Arbitrageurs: Focus on high-liquidity pools to minimize slippage and always account for gas fees when calculating potential profits. Stay updated on network congestion to time your transactions effectively.

Future Trends and Developments

As the world of decentralized finance continues to evolve, we can anticipate a few trends:

- Layer 2 Scaling: As Ethereum 2.0 and other Layer 2 solutions become more widespread, expect reductions in gas fees and faster transactions, making arbitrage even more profitable.

- Cross-Chain Interoperability: The rise of cross-chain solutions will likely introduce new arbitrage opportunities and liquidity pools that span multiple blockchains.

- Advanced Financial Products: With the maturation of the DeFi space, more complex financial products related to liquidity provision and arbitrage are likely to emerge, opening doors for both retail and institutional participants.