What is the Difference Between Retracement and Extension?

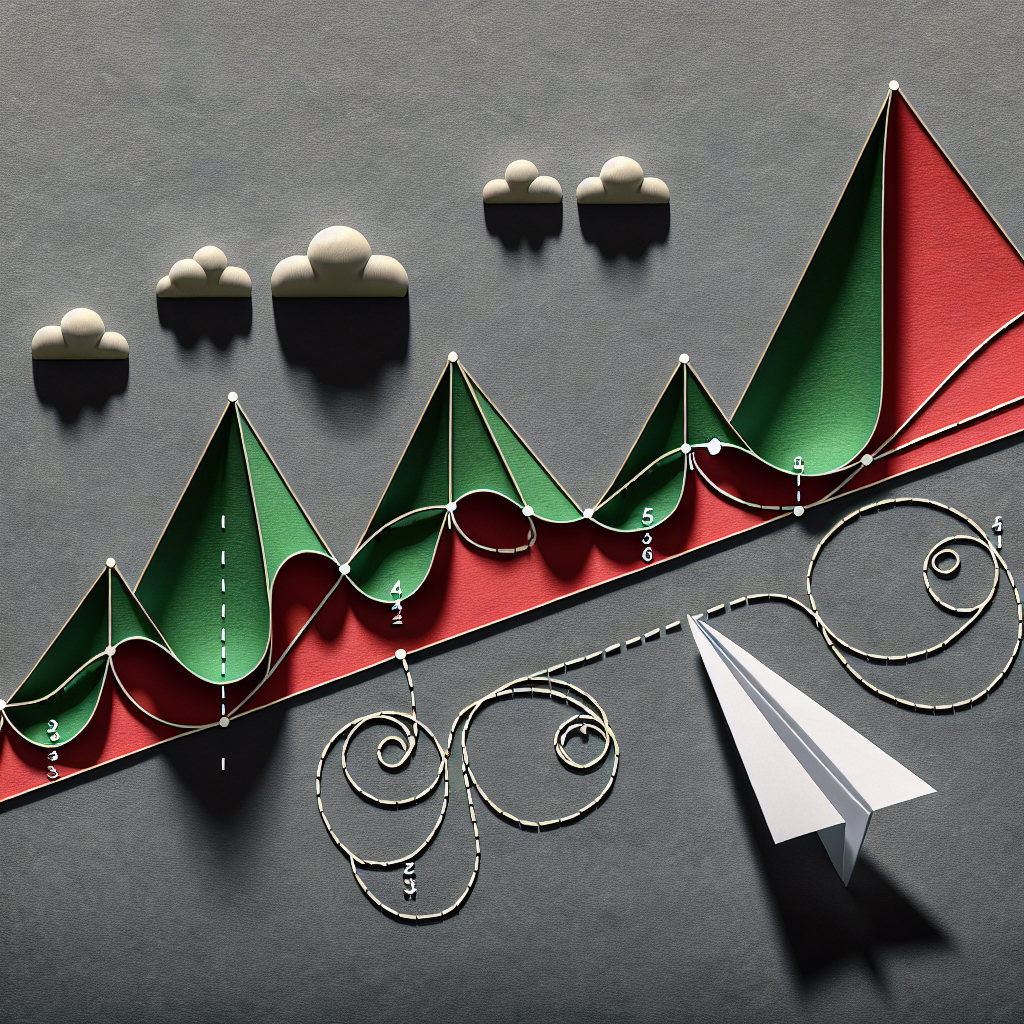

Retracement and extension are essential concepts in technical analysis, particularly in forex trading, that help traders identify potential market reversals and continuation patterns.

Retracement and extension are essential concepts in technical analysis, particularly in forex trading, that help traders identify potential market reversals and continuation patterns.

To interpret price action around Fibonacci levels, traders analyze market movements and patterns that occur near these key retracement levels, enabling them to make informed trading decisions.

Fibonacci retracement levels can be a valuable tool in intraday trading, helping traders identify potential reversal points in the market.

To maximize the effectiveness of Fibonacci trading, it is essential to avoid common mistakes that can lead to losses and missed opportunities.

Fibonacci retracement levels are crucial tools in forex trading, allowing traders to identify potential reversal points where a currency pair may change direction.

The 61.8% level is significant in Forex trading as it is a key Fibonacci retracement level that traders use to identify potential reversal points in the market.

Forex92 Robot applies proven trend-following strategies to help you capture bigger moves while minimizing emotional mistakes.